Equity Return Calculation R

There are many way to learn data science.we can write code.

SieDates <- as.character(format(as.POSIXct(attr(siemens,"times")),"%Y-%m-%d"))SieRet <- timeSeries(siemens * 100,charvec = SieDates)

colnames(SieRet) <- "SieRet"

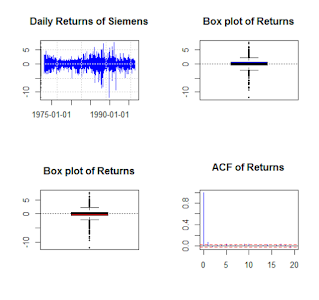

## Stylised Facts 1

par(mfrow = c(2,2))

seriesPlot(SieRet,title = FALSE,main = "Daily Returns of Siemens",col = "blue")

boxPlot(SieRet, title = FALSE, main = "Box plot of Returns",col = "red",cex =0.5,pch = 19)

acf(SieRet,main ="ACF of Returns",lag.max = 20, ylab = "", xlab ="",col = "blue",ci.col = "red")

pacf(SieRet,main ="PACF of Returns",lag.max = 20,ylab ="",xlab= "",col="blue",ci.col="red")

## Stylised Facts II

SieRetAbs <- abs(SieRet)

SieRet100 <- tail(sort(abs(series(SieRet))), 100)[1]

idx <- which(series(SieRetAbs) > SieRet100,arr.ind =TRUE)

SieRetAbs100 <- timeSeries(rep(0,length(SieRet)),charvec = time(SieRet))

SieRetAbs100[idx , 1] <- SieRetAbs[idx]

acf(SieRetAbs,main="ACF of Absolute Returns",lag.max = 20,ylab="",xlab="",col ="blue",ci.col="red")

pacf(SieRetAbs,main="PACF of Absolute Returns",lag.max = 20, ylab="", xlab="",col="blue",ci.col="red")

qqnormPlot(SieRet,main="QQ-Plot of Returns",title = FALSE,col = "blue",cex = 0.5,pch= 19)

plot(SieRetAbs100,type="h",main="Volatility Clustering",ylab="",xlab="",col="blue")

more

https://github.com/manikur/R-programming

0 Comments