What is the FTSE 100 index?

he FTSE 100 Index, commonly referred to as the “Footsie,” is a major stock market index that tracks the performance of the 100 largest companies listed on the London Stock Exchange (LSE). It is widely regarded as a key indicator of the health of the UK stock market and economy. Here’s a detailed overview:

Index Overview

- Name: FTSE 100 Index (Financial Times Stock Exchange 100 Index)

- Type: Stock Market Index

- Country: United Kingdom

- Exchange: London Stock Exchange (LSE)

- Established: 1984

Constituents

- Top Companies: The FTSE 100 includes 100 of the largest companies by market capitalization that are listed on the LSE. These companies are leaders in various industries, including finance, energy, consumer goods, and healthcare.

- Sector Representation: While traditionally strong in sectors like finance and energy, the index also includes significant representation from consumer goods, technology, and healthcare.

Calculation Method

- Market Capitalization-Weighted: The FTSE 100 is a market capitalization-weighted index. This means that companies with larger market capitalizations have a greater impact on the index’s movements.

- Free-Float Adjusted: The index is calculated using free-float market capitalization, which accounts only for the shares available for public trading and excludes those held by strategic investors or insiders.

Purpose and Use

- Benchmark: The FTSE 100 serves as a benchmark for the performance of the largest and most influential companies listed on the LSE. It is often used to gauge the overall health of the UK stock market and economy.

- Investment: It is a key index for investors, fund managers, and analysts. Many investment funds, ETFs (Exchange-Traded Funds), and financial products are designed to track or benchmark against the FTSE 100.

Historical Performance

- 1984: The FTSE 100 was launched on January 3, 1984, with a base value of 1,000 points.

- Growth: Over the years, the index has experienced various market cycles, reflecting the performance of large UK-based companies and broader economic trends.

Significance

- Economic Indicator: As a leading indicator of the UK stock market, the FTSE 100 reflects the performance of major British companies and provides insights into the UK economy’s overall health.

- Global Influence: Many FTSE 100 companies have a significant international presence, so the index also reflects global economic trends and influences.

Recent Developments

- Brexit Impact: The FTSE 100 has been influenced by major geopolitical events such as Brexit, which has had an impact on UK markets and international companies listed on the LSE.

- Sector Shifts: Over time, the index composition has evolved, with shifts in sector representation reflecting broader economic and market changes.

Investment Products

- ETFs and Mutual Funds: There are numerous ETFs and mutual funds designed to track the FTSE 100, allowing investors to gain exposure to the index.

- Derivatives: Futures and options based on the FTSE 100 are available for trading, providing tools for hedging and speculation.

Notable Companies

- Leading Firms: The FTSE 100 includes some of the largest and most well-known companies in the UK, such as HSBC Holdings, BP, GlaxoSmithKline, and Unilever.

Here are some key features and details about the FTSE 100 Index:

Composition: The FTSE 100 Index consists of the 100 largest publicly traded companies listed on the London Stock Exchange. These companies come from various sectors, including finance, energy, healthcare, consumer goods, technology, and more. The composition of the index is reviewed and adjusted periodically to ensure it accurately reflects the market's performance.

Market Capitalization Weighted: The FTSE 100 is a market capitalization-weighted index. This means that companies with a higher market capitalization (the total value of their outstanding shares) have a more significant impact on the index's performance.

Global Significance: Although it represents companies listed on the LSE, the FTSE 100 is closely watched by investors worldwide. It is often used as a barometer for the overall health of the UK economy and as an indicator of global market sentiment.

Diverse Sector Representation: The index covers a broad spectrum of industries, including banking and finance (e.g., HSBC, Barclays), oil and gas (e.g., BP, Royal Dutch Shell), pharmaceuticals (e.g., AstraZeneca, GlaxoSmithKline), retail (e.g., Tesco, Unilever), and more. This diversification helps spread risk for investors.

Price and Total Return Versions: There are two versions of the FTSE 100 Index: the price return version and the total return version. The price return version reflects only changes in the prices of the index's constituent stocks, while the total return version includes dividend income generated by those stocks.

Calculation: The index is calculated and maintained by the FTSE Group, a global financial services company. It uses a formula that takes into account the market capitalization of each company and adjusts for changes such as stock splits and mergers.

Global Investors: Many international investors use financial instruments based on the FTSE 100, such as exchange-traded funds (ETFs) and index futures, to gain exposure to the UK stock market.

Market Hours: The FTSE 100 follows the trading hours of the London Stock Exchange, typically open from 8:00 AM to 4:30 PM (GMT), Monday to Friday.

Historical Performance: The FTSE 100's historical performance reflects the ups and downs of the UK and global economies, as well as trends in various industries.

Volatility: Like most stock indices, the FTSE 100 can experience periods of volatility, influenced by factors such as economic data, geopolitical events, interest rates, and currency fluctuations.

Investors and financial professionals use the FTSE 100 as a reference point for assessing the performance of UK stocks and making investment decisions. It serves as an essential tool for portfolio diversification and risk management.

How to get data in Python?

There are many ways to collect data, I am taking historical data from Yahoo Finance.

What is code in Python to get data?

df = yf.download('^FTSE',

start='1985-01-01',

end='2021-07-28',

progress=False)

How to convert ftse100 data adj column in Python?

df = df.loc[:, ['Adj Close']]

df.rename(columns={'Adj Close':'adj_close'}, inplace=True)

How to get simple and log return FTSE100 in Python?

df['simple_rtn'] = df.adj_close.pct_change()

df['log_rtn'] = np.log(df.adj_close/df.adj_close.shift(1))

How to see simple and log return ftse100 in Python?

df[['simple_rtn','log_rtn']].tail(20)

How to plot ftse100 log return in Python?

simple and log return ftse100

How to plot time series ftse100 in Python?

fig, ax = plt.subplots(3, 1, figsize=(24, 20), sharex=True)

df.adj_close.plot(ax=ax[0])

ax[0].set(title = 'FTSE time series',

ylabel = 'Stock price ($)')

df.simple_rtn.plot(ax=ax[1])

ax[1].set(ylabel = 'Simple returns (%)')

df.log_rtn.plot(ax=ax[2])

ax[2].set(xlabel = 'Date',

ylabel = 'Log returns (%)')

ftse100 time series

How to plot 3 volatility ftse100 in Python?

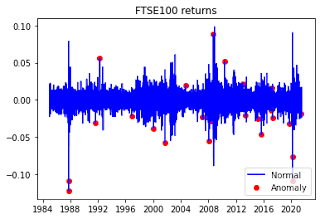

fig, ax = plt.subplots()

ax.plot(df_outliers.index, df_outliers.simple_rtn,

color='blue', label='Normal')

ax.scatter(outliers.index, outliers.simple_rtn,

color='red', label='Anomaly')

ax.set_title("FTSE100 returns")

ax.legend(loc='lower right')

How to draw ftse100 daily return?

df.log_rtn.plot(title='Daily FTSE returns')

0 Comments